Stores closing down soon after opening. We have seen this happen time and again in recent years. Choosing the wrong location is increasingly proving fatal to retailers who are under the growing pressure of e-commerce. But how do you choose the right location? We are sharing our expertise in four articles. Today in Part 3: taking your competition into account.

There are good reasons why competitive pressure is one of the first things you should consider when you are offered or are looking for a new location. After all, every local competitor will take a share of the sales potential! This article tells you how to take full account of the locations and strengths of your competitors.

Direct competitors: dangerous or perfect neighbours?

A newcomer may be a competitor to some and a help to others: a direct competitor can cause both a drop and a rise in turnover. The sales-enhancing effect is mostly seen at locations that attract customers who are complementary to each other. This is because complementarity maximises the chance of combination visits.

You can benefit hugely from the visitors to your perfect neighbours. For example, shoe shops and fashion stores that like to set up shop close to each other or even under the same roof, such as the successful dual-store Torfs & JBC in Belgium. The two retailers achieve no less than 10 percent more turnover thanks to this synergy. Other examples are supermarkets that want to be located close to schools or hearing aid shops that want to be located near GP practices.

The fact that stores can profit from each other's customers is also clearly reflected in the shops-in-shops principle. For example, Douwe Egberts and Hunkemöller rent retail space in Bijenkorf's department stores. And sandwich chain Subway also provides services from particular filling stations and DIY stores.

“There are three reasons why you would want to be located near a competitor.”

When consumers visit your branch purely for destination purchases or services, the chance of revenue cannibalisation is many times greater. This applies, for example, to hairdressers, ice cream shops, and takeaway shops. As the owner of such a branch, you might be very concerned if a direct competitor moves in close by. After all, hair only has to be cut once, and after one ice cream or hamburger, you don't usually want another one. There are three reasons why you would want to be beside a competitor in such a situation.

The first is the diversity of the product range. This is in particular in the fashion industry an important reason because when it comes to fashion or shoes, consumers appreciate a great diversity in the product ranges of the competing stores. People often visit several shoe or fashion stores before making a purchase, meaning that there are many combination visits. Therefore, clustering can have a hugely enhancing effect on the attractiveness of a shopping area.

The second is brand awareness. If you as a retailer are still in the activation phase, your target audience won’t yet know how to find you. In such a case, you can benefit from the traffic that your competitors are already generating. Think of a Jumbo supermarket opening its first store in Belgium right beside an Albert Heijn supermarket.

The third reason is the ‘superhero’ (local hero) effect because if you believe that you can dominate your competitor (their customers will become your customers), it may be smart to set up very close to your competitor.

Internal competition: the cannibalisation effect

Your fellow branch managers or franchisees may be your most formidable competitors. After all, their loss of sales is your loss of sales, and some of their customers are probably your customers too! It is therefore essential to have a clear idea of the catchment areas of the various shops to prevent them from competing with each other. When you use data to define and determine your catchment areas, you will avoid a lot of internal discussions.

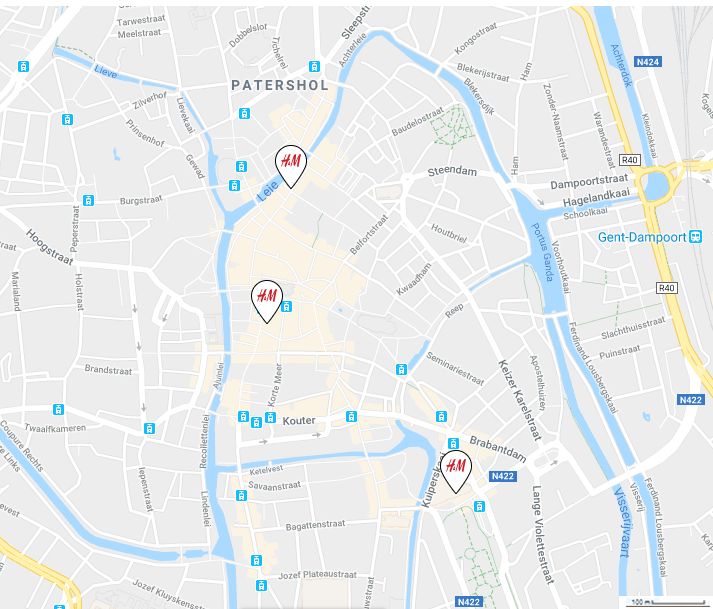

In some urban areas, it is entirely possible to have several shops close to each other. This rule works best for stores in sectors that involve non-destination purchases. An example is H&M, which has several branches in the centre of Ghent.

The main question you have to ask yourself as a retail or franchise manager is whether there are complementary footfall flows. For example, there may be an entirely different type of public one kilometre away.

If the answer is no, shops almost always cannibalise each other’s sales heavily.

Your own webshop: partner and competitor in one!

Don't forget the impact of your webshop when it comes to competitive pressures. Your webshop also delivers a significant part of your organisation’s overall turnover. This makes your webshop both a partner and competitor. Your turnover figures can make this clear.

How competitive the webshop is for consumers depends to a large extent on the distance of potential customers to your physical store. The further away the store is, the likelier it is that the consumer will shop online. Read more about this in our blog about omnichannel retail.

“Keep a good eye on the product ranges of other players”.

Indirect competition

A very ‘tricky’ (because much less visible) form of competition is indirect competition. An example of this is the Quick outlet on Overpoortstraat in the centre of Ghent's student/entertainment district. This outlet had to close down (see photo) unexpectedly because they had not paid enough attention to indirect competitors. There were no major chains in the immediate vicinity, such as McDonald's, Burger King, or KFC. But the area did have an abundance of independent burger restaurants, chip shops, and kebab shops. This is a typical example of overlooking precious information in the location analysis.

It is also essential to keep an eye on the product ranges of other players. For example, the magazine/newspaper section of a supermarket is an indirect competitor for a bookshop. Similarly, the flowers they are selling put them in indirect competition with florists, and their range of pet foods makes them competitors of pet shops.

It is essential to include this indirect competition in the calculation of the overall competitive pressure. Data scientists can estimate the strengths of your indirect competitors based on data and model calculations.

Measure your competitive pressures

The message is clear: measure your competitive pressure as fully as possible. And don't forget your indirect competitors. Accurate screening is essential. Collect as many figures as possible, think of product range, target audience and (open) data about the strengths of the various competitors.