We understand retail

The retail market is a fast-evolving market. Retailers must be able to respond very quickly to changing environmental factors and a changing market. Because for an omnichannel retailer, finding the right location is everything. A wrong decision can have far-reaching consequences. You can now reduce this risk to a minimum with RetailSonar’s statistically accurate models. No more subjective and loose conjecturing so you always make strategic decisions based on the most accurate predictive data.

Smart location decisions. Maximum ROI.

Thanks to curated, best-in-class data, a revolutionary AI model and a passionate team, you can use our platform to make your location decision with confidence, precision and in just a few clicks.

Plan your optimal location network with confidence

Design your most profitable network and plan openings, closures and relocations. With the highest possible accuracy.

Easily improve the performance of your locations

Sales teams can pinpoint the revenue their locations should be making, alongside the right actions to take. In just a few clicks.

Optimize the efficiency of your marketing efforts

Have marketing teams craft precise activation and retention campaigns to ensure they achieve the best ROI. In an easy-to-use platform.

Features relevant to the industry porta laoreet

Performance Academy | Maximize your current location performances (entry level)

Take your network performance to the next level with this beginner-friendly session, designed to identify opportunities and catch...

Performance Academy | Maximize your current location performances (entry level)

Take your network performance to the next level with this beginner-friendly session, designed to identify opportunities and catch...

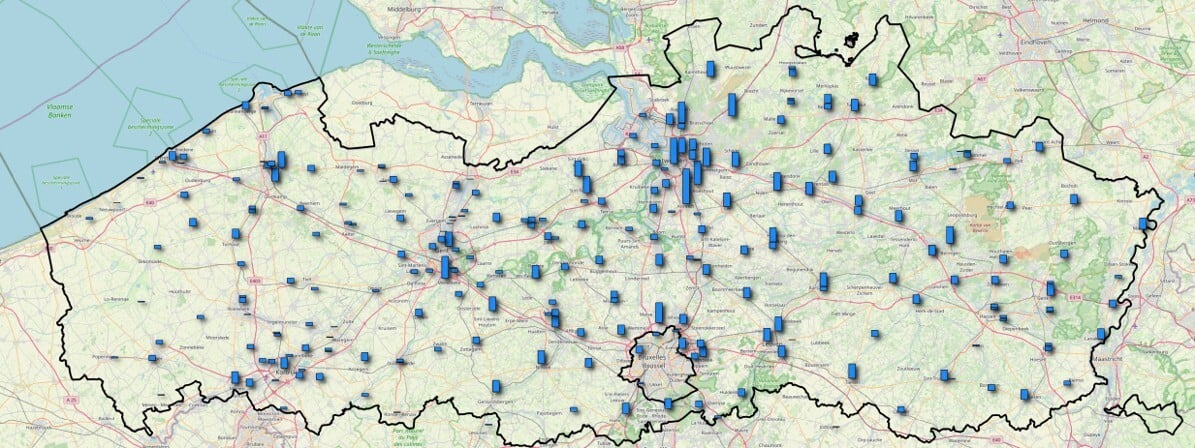

Visualise all the data on a map

- How many people and households are there in a trade area? How is this population composed? What is the annual combined expenditure of these people?

- Where do my customers live and how much market share do I have in these neighbourhoods? How far are my customers prepared to travel?

- Where are my blind spots, the regions with untapped market share?

- Visualise all your competitors on a map, including the surface area of their retail space.

- Visualise structural congestion by road segment. What’s more, the Retail platform factors in this information when determining trade areas.

- Which perfect neighbours generate interesting footfall?

Smartly planning your network

- Estimating the turnover of a potential new shop location?

- How large should the new shop be, how much surface area should it have? How much revenue will an additional m2 generate?

- To which extent does this new shop cannibalise my existing network? Isn’t this shop too close to existing shops?

- What is the net effect on the revenue of my entire network when I open a new shop?

- What is the financial risk if my competitor opens a shop in a nearby vacant retail space?

- How much revenue does a perfect neighbour contribute?

- What are the critical factors for the success of my shops? How important are a car park, visibility and access?

- Which blind spots have enough potential to open another shop and are therefore a hotspot?

Bricks versus clicks

- Where do my online customers live? What is their socio-demographic profile?

- Which online revenue do I generate from customers who live near my shops and what is the online revenue generated by customers who live farther away?

- Which type of customer prefers in-store pick-up and which customers prefer home delivery?

- If I open a new, physical shop, how will this impact my online shop?

- How much revenue can I recover through online sales if I close a shop?

How are my shops performing?

- Is the shop capitalising on its full potential? Is the shop’s performance good or bad, if we take its surroundings into account?

- Should a shop that is already generating a high turnover be able to do even better? Especially if we take into account the high potential of the trade area and the low competitive pressure in the area?

- What caused the bad performance? Is it the area? Or should we place the blame with the shop?

- Possible environmental causes: do some neighbourhoods have a substandard performance? Should we target them with more marketing? Or has their potential decreased? Or the competition increased? Is it worth moving the shop? Or should we consider closing the shop? How many customers can we recover through nearby shops?

- Or is the shop itself the cause? Is the size of its car park insufficient? Could the shop do with some refurbishing? Or is the management to blame?

Campaign management

- How do I reach just as many customers with my flyers and still save 10% on my budget?

- How can I reach even more customers with the same budget?

- Should I flyer even more? Where and where not? What is the ROI of my flyer, by neighbourhood?

- Where should I prefer addressed mail?

- How much municipal tax do I pay in a given region?

- How many mailboxes do I reach and how many have a “no advertising” sticker?

- How do I spread the cost evenly between the various shops and internal services?

Smartly planning and managing your franchise network

- Do I still need my trade areas and are they up to date?

- How can I contribute to an efficient collection of pre-contractual information for new franchisees?

- How can I correctly divide the cost of national marketing campaigns between franchisees?

“We can decide in just five minutes whether a location is worth it, creating more margin for making strategic decisions”

Book a meeting with our retail expert and maximize your ROI

Discover how you can optimize your location strategy by making the smartest location decisions.